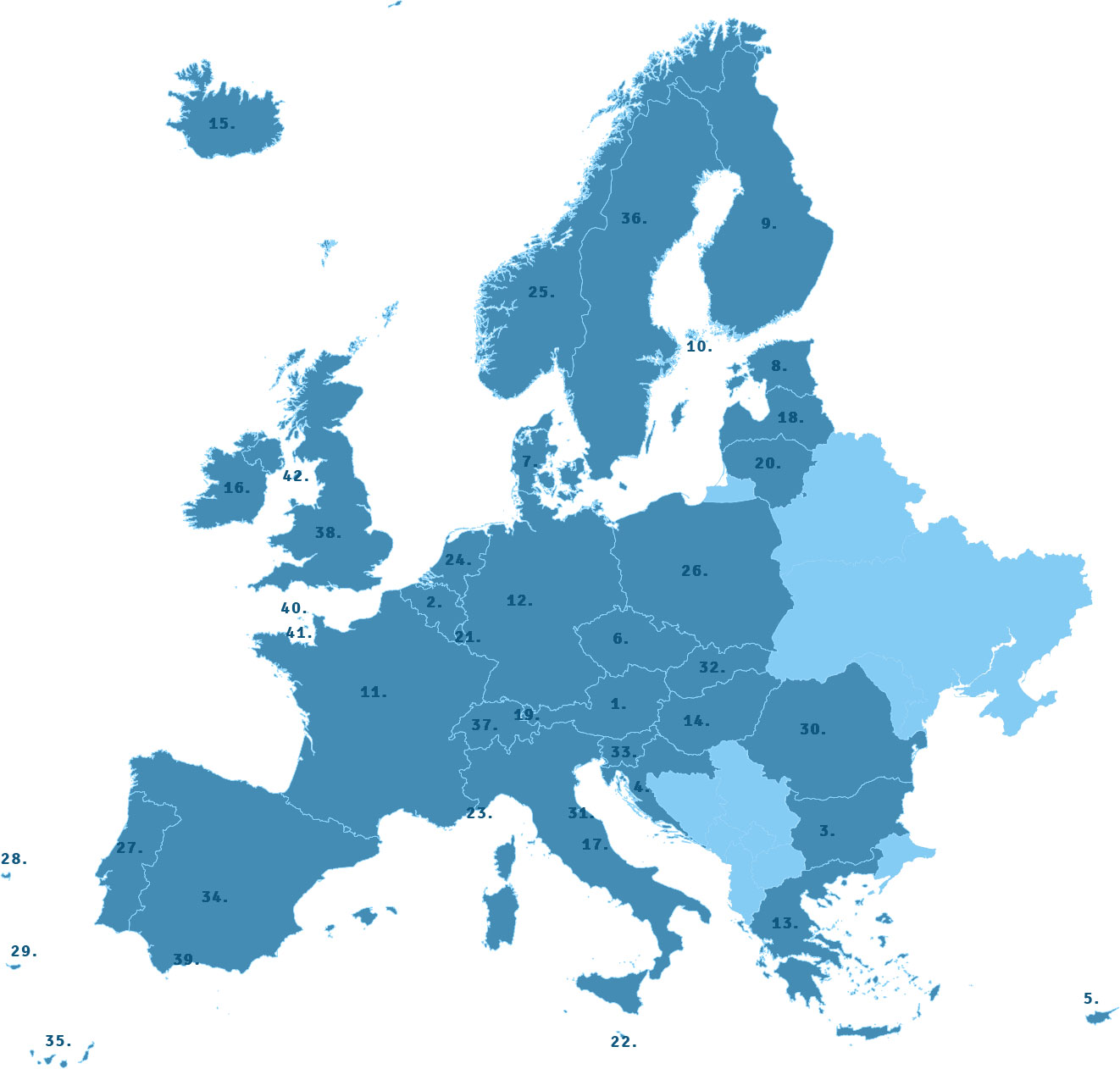

SEPA Area

Made possible to transform the Euro payments landscape into a borderless area, through:

- a harmonized legal framework

- a standardized payment message format

- a common set of rules and procedures

SEPA is the geographical area in which payments in Euro will be possible between any accounts opened with banks operating on the territory of this geographical area, with the same ease and security level, as it is now applicable within national borders.

SEPA countries

As Member State of the European Union, Romania is part of the geographical area characterized by no differences between national and cross-border payments denominated in Euro. As a country where the Euro currency has not been yet adopted, the deadline for taking over the SEPA standards is 31 October 2016.

Legal framework

Directive 2007/64/EC on Payment Services in the Internal Market, transposed into Government Emergency Ordinance (GEO) No. 113/2009 and the Regulation (EU) No. 260/2012 of the European Parliament and of the Council are the two pillars based on which the Single Euro Payment Area was build. Hence, the two legal documents establish the rules applicable for the SEPA payments.

SEPA products

1. SEPA CREDIT TRANSFER

SEPA Credit Transfer scheme (SCT) is an inter-bank payment system whereby a common set of rules and processes is defined and applied to credit transfer operations (payment instructions).

The main SEPA features are:

• The usage of xml ISO 20022 (eXtensible Markup Language) message format

• The “IBAN only” rule – the beneficiary’s bank BIC code becomes an optional field

• The commissioning type is implicitly SHA (the charges deduction principle established by the Payment Service Directive according to which the fees are split between the payer and the beneficiary)

2. SEPA DIRECT DEBIT (RON)

SEPA Direct Debit (SDD) is an inter-bank payment system whereby a common set of rules and processes is defined and applied to direct debit operations (payment instructions transmitted through the payee).

SEPA Direct Debit schemes were implemented under RON Business to Business and CORE in April 2016. BCR is a participant bank for both direct debit schemes (CORE and Business to Business) and the first bank that registered a beneficiary in RUM (Unique Mandate Register) and sent the first direct debit instruction under the new scheme.