Bucharest, 2 December 2015 – The largest recent loyalty campaign in the banking field, BCR’s offer to cut interest rates - Scade Rata (Cut your instalment), was accessed by more than 20,000 clients, within three months after being launched.

“Through our loyalty campaign Scade Rata we facilitate our clients access to efficient loans with clear and immediate benefits: lower rates, on average by 20% at national level, ZERO fees (analysis fee, management fee),FREE life insurance and a substantially easier approval process. We offered our clients a concrete commercial solution, aligned to the existing economic conditions. We managed to reach our goal and we’ll continue to do this”, stated Dana Demetrian, Vice-President Retail & Private Banking, BCR.

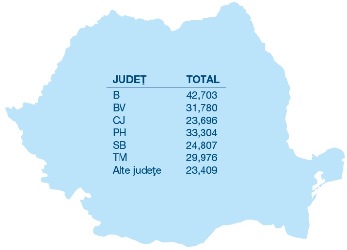

Average value / Refinanced loan (EUR)

So far, the average amount of a refinanced loan is 26,500 EUR at national level. The average decrease of monthly instalments reached approximately 17% for the largest urban localities, as follows: Timişoara – 18%, Sibiu, Ploieşti, Cluj and Braşov – 17%, Bucharest – 16%.

During the Scade Rata campaign, BCR distributed more than 150,000 copies of the Responsible Lending Guide across the country. This guide was developed in partnership with the Association of Romanian Financial Services Users (AURSF) to promote the principles of responsible lending and to improve the financial education of our clients. The Guide includes information, examples and concrete tools to enable better informed financial decisions.

Banca Comercială Română (BCR), a member of Erste Group, is the most important financial group in Romania, providing universal banking operations (retail, corporate & investment banking, treasury and capital markets), and covering specialty companies working on the leasing market, private pensions and housing banks. BCR is Romania’s No. 1 bank in terms of asset value (€14,4 bn.), in terms of client base and in terms of savings and crediting. BCR is also Romania’s most important financial brand, judging by the client trust rate and by the number of persons who consider that BCR is their main banking partner.

BCR uses a network of 22 corporate business centres and 23 mobile offices devoted to corporate clients, and 509 retails units located in most communities inhabited by at least 10,000 citizens in order to provide a full range of financial products and services. BCR is Romania’s No. 1 bank running on the banking transactions market, since BCR customers have the largest ATM network at their disposal – nearly 2,000 ATMs and 13,500 POS terminals, enabling customers to use their cards for shopping purposes, as well as the complete Internet Banking, Mobile Banking, Phone-banking and E-commerce services.

* *

Erste Group is one of the main suppliers of financial services in Eastern European Union. About 46,500 bank officers working in 2,800 branches in seven countries (Austria, the Czech Republic, Croatia, Hungary, Romania, Serbia and Slovakia) assist 16.2 mn. customers. Erste Group reported a total asset pool worth €202,6 bn. and a 56.1% cost-to-income ratio at the end of Q1 of 2015. First-ranking common equity index (Basel 3 implemented partially) has improved to 10.2%.

* *

BCR – External Communication

Alina Daneasa, e-mail: alina.daneasa@bcr.ro

This information is also available on our website: www.bcr.ro.

For more details about the products and services provided by BCR, please use one of the coordinates below to contact us:

InfoBCR

Web: www.bcr.ro

Email: contact.center@bcr.ro

TelVerde: 0800.801.BCR (0800.801.227), toll-free from all national networks.