Andreas J. Zehnder, European Federation of Building Societies:

“Collective Savings and Crediting for the European Housing Sector: A Success Story”

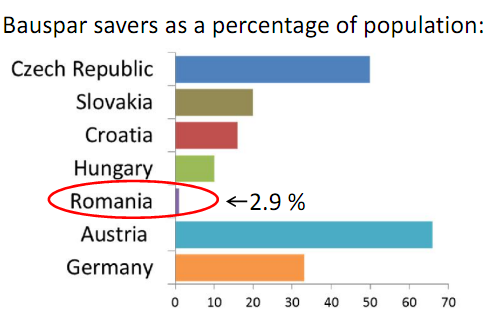

Bucharest, 9 December 2015 – The number of clients benefiting from collective savings and crediting for the Romanian housing sector (also known as the BAUSPAR system) is much lower than in other European countries, which means that it is essential for the State premium for savings-crediting to support the BAUSPAR system, so that the latter may reach maturity and develop, as it happened in the other European countries, declared Andreas J. Zehnder, Managing Director of the European Federation of Building Societies and President of the International Union for Housing Finance.

The key principles of the savings-crediting system are simple. First of all, the BAUSPAR client saves, then the bank extends loans intended for the housing sector, from the savings fund of the other savers, who have the same wish and who are eligible.

“The standard practice is that, in order to receive the State premium for the housing sector, there are no eligibility criteria – any citizen, irrespective of their age, is entitled to the premium for their deposits in relation to the housing sector.

The underlying principle of a savings-crediting contract is that it connects the savings phase to the right to receive a loan for the housing sector. The client is entitled to contract the loan, without being however compelled to it. BAUSPAR systems in Europe are designed with a view to provide long-term financing for the housing sector. Nevertheless, given that it exclusively relies on collective resources, i.e. on the savings of all those who have entered into a savings-crediting contract and who save, the aggregate amount of loans may not exceed, by definition, the sum of savings and the depreciation of loans at any given time. Consequently, attracting people who save for the housing sector and decide not to contract a BAUSPAR loan is equally important.

If the BAUSPAR system has sufficient clients who save for the housing sector, its visibility soars and allows it to provide incentive crediting products. The housing State premium needs to be regarded in this context. An attractive State premium from the State, not subject to restrictive and distinctive rules, attracts a larger segment of the population to the BAUSPAR system and, implicitly, to investments in the housing sector”, clarified Andreas J. Zehnder.

“The decision to contract a loan will always be left at the client’s discretion. No one may be compelled to contract a loan, unless so desired. The most significant aspect of the BAUSPAR system is the fact that many people contribute by their savings to the development of this system, which means that the BAUSPAR system may be regarded as a kitty where many people put money together for the housing sector. Thus, a fund is created aimed at supporting housing investments. This is important in order to understand the operation of building societies, not whether all clients receive a loan, which is impossible to achieve. What is important is that there are sufficient funds for those who intend to invest in the housing sector – upgrading, building, purchase, etc. This is the key issue. This is how collective savings-crediting and building societies work. In all countries, collective savings-crediting for the housing sector is supported by the State, through State premiums. Thus, the State encourages the population to make long-term savings and invest in the housing sector. It is an important signal from the State to the population. The outcome of these State endeavors may be seen in Germany, Austria, or France. Let us encourage people to build their own houses, to invest in the housing sector. This is also useful for the State, because, if many people invest in their own houses, the government no longer needs to worry about their housing condition. We conducted a poll by means of our general audit office, 2 or 3 years ago, which revealed that, even without imposing the condition that such funds be used for housing improvements, 95% of all clients continued to use such money for house-related purposes”, added Andreas J. Zehnder.

A well-rooted BAUSPAR system adds to the economic stability, due to the anti-cyclic operation model. The stabilization function of this model was once again proven during the world crisis of 2007 - 2008. While other creditors worried over the lack of funds or difficulties relating to loans in foreign currency, building societies continued to be able to provide loans to their clients.

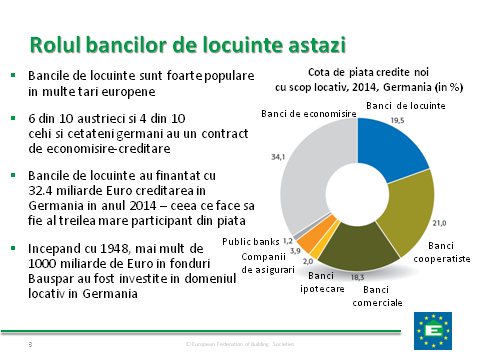

In Europe, building societies and savings-crediting are an important element of the financial system. Thus, emerging societies are well advised if they support the development and extension of savings-crediting for the housing sector. All segments of the population, irrespective of age and predominantly low-income population, are supported by the State through the State premium. In Germany, the savings-crediting system (Bauspar) has more than 80 years’ experience.

“Building Societies in Germany (for instance), where there is a population of 80 million, manage approximately 30 million BAUSPAR contracts, having a value of approximately EUR 865 billion, with a market share of 19.5%. BAUSPAR funds are, in terms of significance, the third financing source for housing in Germany. Starting from 1984, in Germany, more than 13 million lodgings have been built from BAUSPAR funds. In Austria, five out of ten Austrians have a BAUSPAR-type contract, while in the Czech Republic, four out of ten. These impressive figures prove the popularity of building societies even nowadays.

The original reason which formed the basis for the provision of State premium in view of deposits meant for the housing sector in Germany was social-related, in particular – the creation of private capital for the poorer population. The bonus succeeded and continues to succeed even today to attract population groups which would not otherwise bring their savings to the pool of housing sector investments. I would like to remind, in this context, the fact that one of the most important parts of the house building or purchasing process consists of the advance payment. Saving is the best way of accumulating the necessary money. Banks regularly request a considerable down payment before they approve any loan, and a larger down payment – gathered by means of a savings-crediting contract – substantially mitigates risks both for the creditor, and for the borrower”, said Andreas J. Zehnder.

Saving-crediting products are products with a long lifecycle. Clients conclude a saving-crediting agreement for an amount reflecting their intentions in the housing area. A certain amount of money is regularly deposited into the account of the saving-crediting agreement, until it reaches a saved amount of 40% - 50%. This type of approach towards ensuring future housing comfort requires good planning of own financial resources and personal financial discipline over an extended period of time.

Regardless of the citizens’ age, the government encourages their effort in seeking to improve their own housing situation, and in giving up immediate consumption in favor of long-term investments in the housing field. The government’s incentive for the citizens’ effort is in the form of a state premium amounting to 25% of annual savings, no more than EUR 250/year (the equivalent in RON). Upon the completion of the saving process and provided that the distribution conditions were fulfilled, the client becomes entitled to access a loan of 50% - 60% of the contracted amount. Both in respect of saved amounts, and for crediting, the bank provides fixed interest.

Cezar Marin, e-mail address: cezar.marin@bcr.ro

Gina Ursache, e-mail address: gina.ursache@railoc.ro

Tel: 0728.009.888