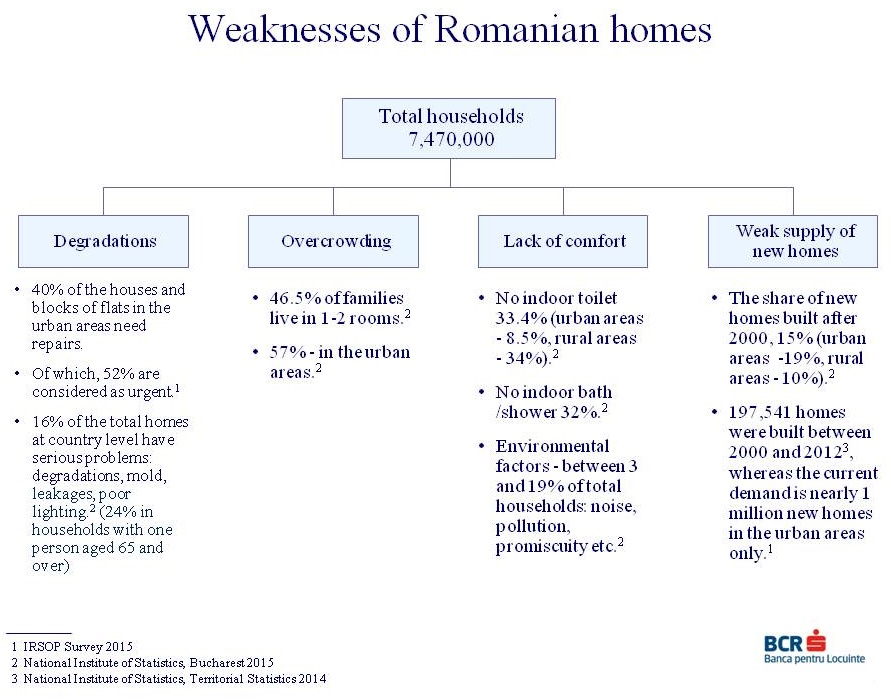

Almost half of the Romanian families (46%) live in one or two rooms. In towns, the percentage can be as high as 57%. However, the numbers become more dramatic when looking at the size of families. The market surveys conducted by the BCR Housing Bank (BCR BpL) with the help of IRSOP have revealed that 40% of the 3 member families, 32% of the 4 member families, 20% of the 5 member families and 20% of the 6 member families live in no more than two rooms.

"Let’s try for a moment to imagine the daily life of a 4 or 6 member family in a 2 room apartment: how do these people rest? How do they eat? How can they meet their need for intimacy? Where do they keep their belongings? How do they prepare for school or work? How do they manage their conflicting preferences? What is the general feeling? Oddly, the excessive overcrowding in the Romanian homes is not among the topics of public debate and no one, apart from the respective dwellers, seem to worry about it”, Dr. Petre Datculescu, Director of IRSOP, declared.

All living creatures suffer when their living space is overcrowded. Crammed animals reproduce more slowly, do not take care of their young ones properly and become susceptible to diseases. Studies have showed that people crammed into overcrowded spaces have lower levels of intellectual performance, become more secluded and less tolerant in their inter-human relationships. The research conducted by IRSOP on this topic reveals that people coming from large families living in cramped spaces report increased nervousness and frustration and a feeling of being constraint and having no control over their own life, Dr. Petre Datculescu, Director of IRSOP, says.

All living creatures suffer when their living space is overcrowded. Crammed animals reproduce more slowly, do not take care of their young ones properly and become susceptible to diseases. Studies have showed that people crammed into overcrowded spaces have lower levels of intellectual performance, become more secluded and less tolerant in their inter-human relationships. The research conducted by IRSOP on this topic reveals that people coming from large families living in cramped spaces report increased nervousness and frustration and a feeling of being constraint and having no control over their own life, Dr. Petre Datculescu, Director of IRSOP, says.

However, the most serious effect of living in overcrowded conditions is resignation. People feel discouraged and get used to the idea that they will not be able to improve the current uncomfortable living conditions. This psychological effect is called ”learned helplessness” and happens when people realize there is no escape, because their own powers are not sufficient and there is no help from outside. Crammed families do not need compassion, they need help, which means access to funds, governmental policies and strategies for improving housing conditions, and mainly public awareness of the risks of cramped living, Dr. Petre Datculescu said.

The saving-crediting products have a long life cycle. Customers conclude a saving-crediting contract for an amount that reflects their housing plans. They deposit a certain amount into the saving-crediting contract’s account on a monthly (or annual) basis, until the saved amount accounts for 50% of what is necessary. This approach to providing housing comfort in the future requires some planning of your own financial resources and long-term individual financial discipline.

The State is encouraging people’s effort toward the improvement of their own housing situation, their endeavour to give up immediate consumption in order to make long-term investments in housing. The State is encouraging people’s effort by granting them a premium of 25% of their annual savings, which does not exceed 250 EUR/year (in RON equivalent). At the end of the saving process, depending on the extent to which allocation conditions are met, customers get the right to take out a loan amounting to 50% of the sum contracted from the saving-crediting bank. The bank provides a fixed interest rate on both the saved and the borrowed amounts.

* *

Banca Comercială Română (BCR), a member of Erste Group, is the most important financial group in Romania, providing universal banking operations (retail, corporate & investment banking, treasury and capital markets), and covering specialty companies working on the leasing market, private pensions and housing banks. BCR is Romania’s No. 1 bank in terms of asset value (€14,4 bn.), in terms of client base and in terms of savings and crediting. BCR is also Romania’s most important financial brand, judging by the client trust rate and by the number of persons who consider that BCR is their main banking partner.

BCR uses a network of 22 corporate business centres and 23 mobile offices devoted to corporate clients, and 509 retails units located in most communities inhabited by at least 10,000 citizens in order to provide a full range of financial products and services. BCR is Romania’s No. 1 bank running on the banking transactions market, since BCR customers have the largest ATM network at their disposal – nearly 2,000 ATMs and 13,500 POS terminals, enabling customers to use their cards for shopping purposes, as well as the complete Internet Banking, Mobile Banking, Phone-banking and E-commerce services.

* *

Erste Group is one of the main suppliers of financial services in Eastern European Union. About 46,500 bank officers working in 2,800 branches in seven countries (Austria, the Czech Republic, Croatia, Hungary, Romania, Serbia and Slovakia) assist 16.2 mn. customers. Erste Group reported a total asset pool worth €202,6 bn. and a 56.1% cost-to-income ratio at the end of Q1 of 2015. First-ranking common equity index (Basel 3 implemented partially) has improved to 10.2%.

* *

BCR – External Communication

Cezar Marin, e-mail: cezar.marin@bcr.ro

For more details about the products and services provided by BCR, please use one of the coordinates below to contact us:

InfoBCR

Web: www.bcr.ro

Email: contact.center@bcr.ro

TelVerde: 0800.801.BCR (0800.801.227), toll-free from all national networks.

Twitter: @infoBCR