Summary1 :

Open for business:

- The stock of net customer loans granted by Banca Comerciala Romana (BCR) advanced by 7.4% yoy as of 31 December 2020 supported by both retail and corporate segments

- New loans in local currency of RON 8 billion granted in 2020 for households (mortgage and unsecured consumer) and micro-businesses

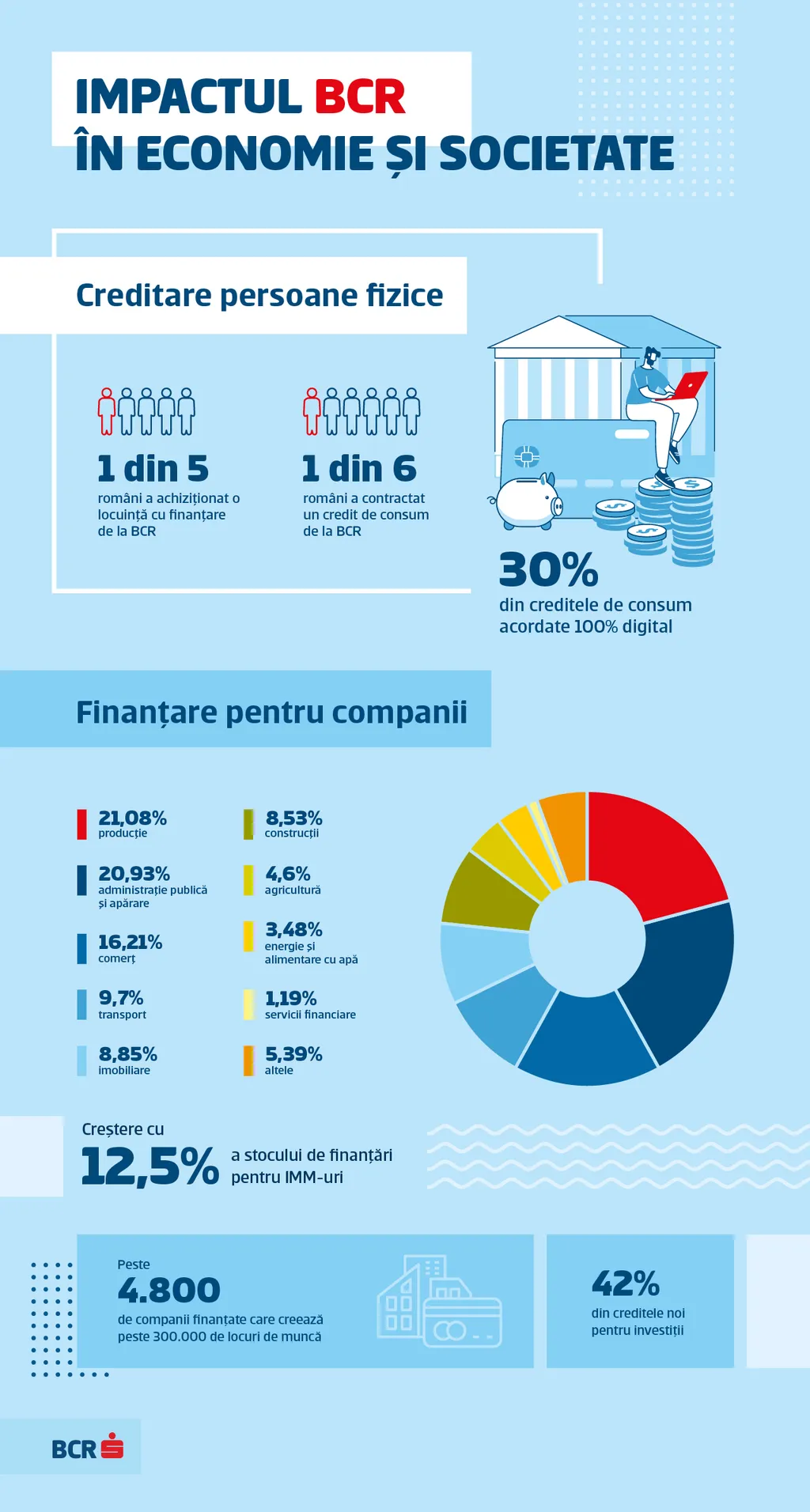

- 1 in 5 Romanians purchased a mortgage from BCR, while 1 in 6 Romanians contracted a consumer loan from the bank

- New approved corporate loans up by 24.5% in 2020, exceeding 9.3 billion, of which 42% investment loans

- Support for entrepreneurs, stock of financing for SME segment up by 14.8% yoy as of 31 December 2020

Support for customers in the current context:

- Over 4,800 companies that generate 300,000 jobs were supported last year through new loans, granted through the SME Invest programme and credit extensions

- Over 1,800 loans in total amount of RON 1.2bn approved within the SME Invest program

Accelerated digitization:

- 1.8 million users for internet and mobile banking, out of which over 1 million active users in George, up by 60% as compared to 2019

- George becomes the digital ecosystem that offers 100% online availability for the most retail banking products (current accounts, savings, loans and insurances)

- The number of transactions in George increased by 102% in 2020 compared to 2019

BCR achieved a net profit of RON 814.1 million (EUR 168.3 million) in 2020

“Adaptability and resilience were the dominant words in business, but also on the personal side for all my colleagues. BCR put first the employees’ safety and the financial health of its customers, and we managed to overcome the obstacles together, coming out stronger. I want to thank my colleagues for their agile adjustment to the context, but also for their dedicated and passioned work. We have continued to learn from the reinventing power of our customers, and we were fully open for business, being a reliable partner for entrepreneurs and companies in their effort to ensure jobs continuity. We offered financing solutions in key sectors of the economy so that Romania SA and Romania SRL continue to deliver added value. Our mission continues in 2021: we are here to offer real support for smart financial choices, by adapting to customer needs, through personalized financial services, continuous digital transformation, and inclusive educational programs”, stated Sergiu Manea, CEO Banca Comercială Română.

Measures taken in the context of Covid-19

- Deferred instalments for about 41,000 loans for individuals and about 500 loans for companies, majority choosing BCR solution. Over 3,600 deferred instalments requests were made through a fully digital flow in George.

- Over 350,000 individual customers benefited from the 3 months postponement of the mandatory minimum monthly payment amount for credit cards and overdrafts.

- Deferred instalments in 2020 in support of the customers affected by the pandemic context represented 13% out of the total loan portfolio for individuals and 10% of the total loan portfolio for non-financial companies.

- Over 30% of the personal loans were granted in 2021 on a fully digital flow.

- Half of the customers who applied for a 100% online cash loan opted also for a life, unemployment, temporary or permanent loss of work capacity insurance.

- The bank has implemented a new operational model in the retail units, based on which customers have access in branches only through a phone appointment. Over 70% of customers have scheduled their visit to the bank from home.

BCR impact in the economy

In retail banking business, BCR generated total new loans in local currency to individuals and micro businesses of RON 8 billion in 2020. BCR gained market share yoy in RON new consumer to 17.4% (+1.6 pp) and in new mortgage to about 20% (+3 pp) despite the adverse pandemic context. Mortgage new sales in local currency increased by 28% yoy, mainly driven by Casa Mea mortgage product which represents 71% of the total production. Also, BCR continued to support the state guaranteed product Noua Casa, reaching a market share of 30%. Stock of mortgage in local currency increased by 20% yoy in 2020, while the stock of consumer loans increased by 8% yoy.

In corporate banking business, BCR (bank standalone) approved new corporate loans of RON 9.3 billion in 2020, up by 24.5% yoy. The main driver was the advance of stock of financing granted to SME segment (including BCR Leasing subsidiary) which increased by 14.8% yoy to RON 7.0 billion (EUR 1.4 billion) as of 31 December 2020, as a result of a high focus on new business and advance in leasing and BCR’s participation in SME Invest program. Also, the Public Sector financing increased by 21.6% yoy and the Real Estate financing by 7.0% yoy.

The intelligent banking platform George exceeded 1 million active users, up by 43% as compared to 2019. George displays online the largest number of retail banking products (current accounts, savings, credit, and insurances). Thus, in 2020 several unique products were launched in the George platform: online refinancing, online credit card and online overdraft (launched at the end of 2020 – already 50% of credit cards and overdraft contracts were granted on fully digital flow), Multi Protect insurance and credit insurance. George Moneyback, the loyalty program that offers money back in return, as discount, when customers use card payments reached 310,000 users in just five months. Over 95% of new savings accounts in 2020 have been initiated through George.

Casa Mea App, that runs document workflow for standard mortgages on mobile phone or tablet, has been used for 40% of the Casa Mea mortgage loans.

The Money School programme reached over 30,000 adults and children in 2020, having organized financial education online sessions and dedicated workshops for them. The total number of people that have interacted with the program exceeds 430.000. The BCR Business School, the entrepreneurial education program reached 10,000 users (entrepreneurs, managers, freelancers, teachers, and students) that have subscribed on the platform or participated at online sessions. Within the INNOVX-BCR business accelerator program, last year 62 start-ups (up to EUR 1 million) and scale-ups (companies with turnovers or attracted funds of over EUR 1 million) were accelerated or incubated, from all over the country.

2020 financial highlights

BCR achieved a net profit of RON 814.1 million (EUR 168.3 million) in 2020 from RON 593.3 million (EUR 125.0 million) in 2019 underpinned by strong loan growth and better operating performance, partly offset by higher risk costs. The net profit in 2019 was affected by a significant one-off provision allocation related to the activity of BCR Banca pentru Locuinte booked in Q2 2019.

Operating result improved by 5.1% to RON 1,877.5 million (EUR 388.1 million) in 2020 from to RON 1,786.9 million (EUR 376.5 million) in 2019, on the back of higher operating income along with lower operating expenses.

Net interest income increased by 5.1% to RON 2,371.0 million (EUR 490.1 million) in 2020, from RON 2,256.3 million (EUR 475.5 million) in 2019, favoured by higher loan and deposit volumes in both retail and corporate, partly offset by impact from lower market rates.

Net fee and commission income decreased by 9.0%, to RON 710.0 million (EUR 146.8 million) in 2020, from RON 780.6 million (EUR 164.5 million) in 2019, driven by lower cash withdrawal and waived withdrawal fee at non-BCR ATMs in April and May as support measure during the state of emergency.

Net trading result increased by 1.2%, to RON 356.5 million (EUR 73.7 million) in 2020, from RON 352.4 million (EUR 74.3 million) in 2019, mainly driven by higher trading activity.

Operating income increased by 1.6%, to RON 3,546.3 million (EUR 733.0 million) in 2020, from RON 3,490.4 million (EUR 735.5 million) in 2019, driven by higher net interest income and net trading result, partly offset by lower fee income.

General administrative expenses reached RON 1,668.8 million (EUR 344.9 million) in 2020, down by 2.0% in comparison to RON 1,703.5 million (EUR 359.0 million) in 2019, mainly due to lower contribution to deposit insurance fund in 2020 versus 2019 and lower depreciation, partly offset by higher personnel expenses and costs related to new head office in 2020.

As such, cost-income ratio improved to 47.1% in 2020, versus 48.8% in 2019.

Risk costs and Asset Quality

Impairment result from financial instruments recorded an allocation of RON 521.3 million (EUR 107.7 million) in 2020, as compared to a release of RON 61.8 million (EUR 13.0 million) in 2019. This result has been influenced by prudent measures taken by the bank in order to anticipate any potential negative effect of the pandemic context, measures mainly translated into updated risk parameters based on the most recent macroeconomic scenarios and the implementation of stricter rules for credit risk classification under IFRS 9 applied to client exposures affected by the current situation.

NPL ratio reached 4.5% as of December 2020 against 4.1% recorded as of December 2019. This evolution is mainly reflecting the effect of a one-off large default registered in the corporate segment in the second quarter of 2020, as well as higher new NPLs in the retail segment as a result of an assessment for unlikeness to pay performed in the fourth quarter on clients with still active instalment deferral agreements. At the same time, the NPL provisioning coverage reached 122.5% as of December 2020.

Capital position and funding

Solvency ratio for BCR Bank standalone, according to the capital requirements regulations (CRR) stood at 20.51% as of December 2020, well above the regulatory requirements of the National Bank of Romania. Furthermore, the Tier 1+2 capital ratio of 19.42% (BCR Group) as of December 2020 is clearly reflecting BCR’s strong capital and funding positions.

Loans and advances to customers increased by 7.4% to RON 43,002.5 million (EUR 8,833.2 million) as of 31 December 2020 from RON 40,049.0 million (EUR 8,373.2 million) as of 31 December 2019, supported by increases in both retail (+6.9% ytd) and corporate (+7.8% ytd).

Deposits from customers strongly increased by 12.3% to RON 64,876.8 million (EUR 13,326.4 million) as of 31 December 2020 versus 57,791.8 million (EUR 12,082.8 million) as of 31 December 2019, supported by increases in both retail (+10.9% ytd) and corporate (+16.4% ytd) deposits.

***

BCR provides a full range of financial products and services, through a network of 18 business centers and 16 mobile offices dedicated to companies and 370 retail units located in most cities across the country with over 10,000 inhabitants. BCR is the No. 1 bank in Romania in the market of bank transactions, BCR customers having available the largest national network of ATM and multifunctional machines- almost 1,800, approximately 13,000 POS and complete services of Internet banking, Mobile banking, Phone-banking and E-commerce.

***

For more information please contact press office at: comunicare@bcr.ro

This information is also available on our website: www.bcr.ro

For more details about the products and services provided by BCR, please contact InfoBCR at

· Internet page: www.bcr.ro

· Email: contact.center@bcr.ro

Telverde: *227, toll-free from all national networks