12 November 2015

Press release

12 November 2015

Press release

Bucharest, 12 November 2015 – Out of a total of approximately 7.5 million Romanian households, around 40% of the houses and blocks of flats in the urban areas need repairs, whereas 52% of such repairs are deemed as urgent, according to an IRSOP’s survey conducted at the behest of BCR Housing Bank (BCR Banca pentru Locuinte, BCR BpL).

On the other hand, the data revealed by the National Institute of Statistics show that approximately 16% of the households throughout the country are facing serious problems in relation to housing, such as degradation, dampness, leaking water and sewerage networks, poor lighting. Furthermore, 34.00% of the households in the rural areas have no toilet. In the urban areas, 8.5% of households have no toilet and 32% have no bathtub/shower inside.

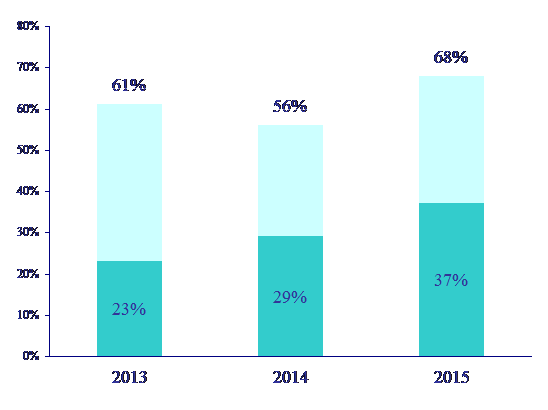

According to the IRSOP’s survey, approximately 68% of those interviewed wish to start housing improvement projects over the next 5 years, and around 37% are planning to do so over the next 12 months.

The most frequent housing improvement projects for the next 5 years are related to refurbishment (29%), buying a new house (23%), buying a house in the countryside (23%), thermal enveloping (23%), repairing sanitary facilities or electrical installations (21%), buying a heat plant (16%), various works at roofs or terraces (15%), building a house (13%), repairing the structural frame (11%), buying land (9%), extending the current house (8%).

As regards the resources necessary to fund housing investments, 68% of those interviewed have housing investment plans for the next 5 years, the percentage being above the one in 2014, i.e. 56%. 25% of those interviewed say they have funds reserved for housing investments, the percentage declining as compared to last year, when it was 29%.

One of the options for providing long-term housing investments is collective saving-crediting. The saving-crediting for housing purposes has significantly evolved over the past years.

The results so far bear witness to this. Further to the evolution undergone by BCR Housing Bank (BCR BpL) until now, the balance of deposits is over 2.6 billion RON. The portfolio of BCR Housing Bank includes over 386,000 saving-crediting contracts, the concluded contracts amounting to 2.5 billion RON.

The loan portfolio granted by BCR Banca pentru Locuinţe S.A. has risen by 16% to more than 176 million RON.

The saving-crediting products have a long life cycle. Customers conclude a saving-crediting contract for an amount that reflects their housing plans. They deposit a certain amount into the contract’s account or the saving-crediting account on a monthly (or annual) basis, until the saved amount accounts for 50% of what is necessary. This approach to providing housing comfort in the future requires some planning of your own financial resources and long-term individual financial discipline; it also stimulates people’s own initiative of engaging in the improvement of their own housing conditions.

The State is encouraging people’s effort toward the improvement of their own housing situation, their endeavour to give up immediate consumption in order to make long-term investments in housing. The State is encouraging people’s effort by granting them a premium of 25% of their annual savings, which does not exceed 250 EUR/year (in RON equivalent). At the end of the saving process, depending on the extent to which allocation conditions are met, customers get the right to take out a loan amounting to 50% of the sum contracted from the saving-crediting bank. The bank provides a fixed interest rate on both the saved and the borrowed amounts.

* *

Banca Comercială Română (BCR), a member of Erste Group, is the most important financial group in Romania, providing universal banking operations (retail, corporate & investment banking, treasury and capital markets), and covering specialty companies working on the leasing market, private pensions and housing banks. BCR is Romania’s No. 1 bank in terms of asset value (€14,4 bn.), in terms of client base and in terms of savings and crediting. BCR is also Romania’s most important financial brand, judging by the client trust rate and by the number of persons who consider that BCR is their main banking partner.

BCR uses a network of 22 corporate business centres and 23 mobile offices devoted to corporate clients, and 509 retails units located in most communities inhabited by at least 10,000 citizens in order to provide a full range of financial products and services. BCR is Romania’s No. 1 bank running on the banking transactions market, since BCR customers have the largest ATM network at their disposal – nearly 2,000 ATMs and 13,500 POS terminals, enabling customers to use their cards for shopping purposes, as well as the complete Internet Banking, Mobile Banking, Phone-banking and E-commerce services.

* *

Erste Group is one of the main suppliers of financial services in Eastern European Union. About 46,500 bank officers working in 2,800 branches in seven countries (Austria, the Czech Republic, Croatia, Hungary, Romania, Serbia and Slovakia) assist 16.2 mn. customers. Erste Group reported a total asset pool worth €202,6 bn. and a 56.1% cost-to-income ratio at the end of Q1 of 2015. First-ranking common equity index (Basel 3 implemented partially) has improved to 10.2%.

* *

BCR – External Communication

Cezar Marin, e-mail: cezar.marin@bcr.ro

This information is also available on our website: www.bcr.ro.

For more details about the products and services provided by BCR, please use one of the coordinates below to contact us:

InfoBCR

Web: www.bcr.ro

Email: contact.center@bcr.ro

TelVerde: 0800.801.BCR (0800.801.227), toll-free from all national networks.

Twitter: @infoBCR